FAQ

SET Opportunity Day Q&A

1. How does the company view the growth of the EV business, and what are the outlet expansion plans?

Growth is expected to continue in line with the increasing number of EVs. In the early stages, the growth rate may be higher than in later periods, when expansion could slow. This quarter, OR added 17 new EV Station PluZ locations from the previous quarter. Performance has improved, although it may not yet be positive. Overall, the company views this as a promising business that will replace the gradually declining fossil fuels. In addition, OR continues to enhance its application to better support user needs.

2. How has Cafe Amazon performed since introducing the new presenter? Have SSSG and margins improved?

The new presenter has helped strengthen brand awareness for premium products, driving strong growth. The company targets 50% growth. Overall, SSSG has improved by 1 - 2%.

3. How many Cafe Amazon outlets does management expect nationwide, and what are the expansion plans for next year?

Domestic expansion is expected to be similar to this year, at around 280 branches. Cafe Amazon will continue to expand both domestically and internationally, although the investment scale may be smaller or adjusted based on the suitability of the area.

4. What is the company’s approach to utilizing the remaining cash balance?

OR needs to maintain a cash balance of at least THB 8.5 billion, manage this cash to maximize returns, while continually seeking suitable investment opportunities. OR plans to invest further in the Lifestyle business, allowing new brands to strengthen the ecosystem. In the Mobility business, despite stable long-term growth, OR continues to strengthen its network and service-station standards. For the Global business, investment continues in segments with attractive opportunities. OR also considers dividend payments, currently maintaining a 50% payout ratio with a yield of approximately 3.6%.

5. What is the demand outlook for oil in the Retail and Commercial markets next year?

Sales volume is expected to grow around 1–2%, in line with national GDP. Retail demand is declining as EV adoption increases, although the decline in OR is lower than that of the overall market. For commercial sales, demand for aviation fuel continues to grow.

6. Does the company plan to expand PTT Station and Café Amazon to additional countries?

OR continues to focus on expansion within Southeast Asia, strengthening markets where OR currently operates. OR also grants Master Franchise rights in countries such as Oman, Japan, and Malaysia, providing an additional channel for business expansion.

7. What is the outlook for the Global business in 4Q25 and FY2026?

Growth may slow due to market trends toward renewable energy. The Philippines continues to grow strongly, Laos grows in line with its GDP, but Cambodia may be affected by ongoing border conflicts, which have had an impact since 2H68.

8. What is the performance outlook for 4Q25 and FY2025 revenue?

The fourth quarter is typically high season, and oil prices are usually volatile. However, this year, prices have remained relatively stable. OR manages inventory and hedging appropriately. Performance is expected to meet projections.

9. With the Oil Fund’s status steadily improving, does OR expect marketing-margin volatility to decrease going forward?

The Oil Fuel Fund status does not directly affect marketing margins, as the margin range is set by the Fuel Fund Executive Committee. OR’s marketing margin typically fluctuates within a ± THB 1 range.

10. What are the company’s growth targets and CAPEX plan for 2026?

The CAPEX plan is being prepared and awaits approval. OR will disclose details to the SET once finalized. Investment will continue across Mobility, Lifestyle, and Global businesses.

11. What are the growth target for found & found?

found & found is in the early stages, targeting 50 sales points by 2026. Sales have gradually improved through better location selection and product alignment with customer needs.

12. When does the company plan to begin operating the hotel business?

The hotel business aims to enhance convenience for travelers. OR will co-invest with a reputable and experienced partner. Clearer details are expected by the end of 2025, and construction is anticipated to commence in early 2026.

13. What are the opening and closure rates of Otteri, and how does the company view laundromats with increasing closure rates?

The laundromat market is highly competitive with low entry barriers. Otteri has improved the application, focusing on high-quality machines and emphasizing suitable locations. Overall, the market is still growing, though not at a high rate. The business is expanding internationally, receiving a positive response in Cambodia.

14. What is the proportion of PTT Station termination requests in Cambodia relative to the total number of service stations?

Approximately 50–60 dealers are expected to terminate their PTT Station contracts. (As of 3Q25, there were 155 stations, 10% COCO : 90% DODO)

15. What is the current occupancy rate in PTT Stations, and how is the tenant mix being adapted to meet modern consumer needs that extend beyond refueling?

As of 3Q25, the occupancy rate was at 85%. OR has implemented a Geo-analytics System to analyze consumer behavior in each area, allowing the company to optimize store space allocation and better respond to consumer needs.

16. Will ORZON Ventures invest further in Health & Wellness or Tourism to reduce reliance on oil revenue?

ORZON Ventures evaluates startup investments based on early-stage suitability, enabling OR to access new technologies and innovations that support the ecosystem and future business development, while also generating a financial return.

17. Which is more beneficial to OR: THB depreciation or appreciation?

THB depreciation of the Thai baht is more beneficial to OR, as OR is a net dollar recipient.

1. What is the outlook for operating performance in 3Q25 and for 2025?

Overall performance in 2H25 is expected to remain stable, with the full-year net profit estimated at THB 10 billion. Key supporting factors include the government’s tourism stimulus measures and the recovery of exports. However, certain risks, such as global oil price movements and the ongoing tension between Thailand and Cambodia, still need to be monitored.

2. What is the investment progress in the F&B business, and are there plans to invest in other businesses?

The investment in the F&B business is progressing according to the planned timeline and is expected to be operational by 4Q25. In addition, OR places great importance on investing in new businesses to enhance the OR Ecosystem, with ongoing studies into potential opportunities in the Health & Wellness sector and Budget Hotels.

3. What is OR’s EBITDA target for this year and next year?

For 2025, EBITDA is targeted to return to the normal level of around THB 20 billion. This will be driven by strengthening the core businesses. Also, sales volume and margins are expected to remain within the projected range.

4. How does OR assess the situation in Cambodia, and what are the plans to handle it? What impact is expected?

On the Thai side, some border-area service stations have been affected, albeit to a limited extent. OR has implemented appropriate support for impacted dealers as necessary.

On the PTTCL side, the situation may lead to a decline in sales volume, with a more noticeable effect anticipated in 3Q25. For 2Q25, the impact has been relatively minor. The EBITDA contribution from PTTCL accounts for approximately 5–7% of the OR Group’s total. OR continues to maintain the existing business and closely monitors the situation.

5. What is the sales growth target for oil this year, and why?

Oil sales volume is expected to grow in line with Thailand’s GDP. 2025 GDP is projected to expand in the range of 1.8% to 2.3%. The main portion will be from aviation fuel, which aligns with the country's demand.

6. What percentage of Cafe Amazon branches are outside PTT stations, and will future expansion be mostly outside PTT stations?

The proportion of Cafe Amazon outlets located inside and outside PTT stations currently stands at 50:50. Site selection is not limited to whether the store is inside or outside a service station but rather focuses on securing suitable locations without overlapping with existing branches. In addition, OR is considering expanding branches in the Compact Model format, which requires lower investment and offers faster payback.

7. Is there an opportunity to increase market share in 2H25, and what is the expected market share by year-end?

The 2025 OR market share is projected to be around 40%–42%. OR aims to increase the market share by 1%–2% through continuous promotional activities and improved service quality.

8. What is the progress in finding partners to hold shares that align with PTT’s policy to strengthen subsidiaries?

This initiative is still under study and consideration.

9. Competitors in coffee shops are expanding aggressively and continuously offering coffee discounts. How does the company plan to maintain market share and achieve sales targets?

Cafe Amazon continues to pursue its branch expansion plan, adding around 200–300 outlets per year. The store formats will be tailored to suit each location, focusing on increasing ticket size by expanding the share of non-beverage products.

In addition, Cafe Amazon plans to carry out ongoing promotional activities and introduce seasonal menus to attract more customers. Recently, it launched the “Amazon Premium Selected Cup,” building on its strengths of accessibility and affordable pricing, aiming to expand into new customer segments while maintaining its existing base through the Cafe Amazon Rewards program.

1. What is the outlook for the Mobility and Lifestyle businesses in 2Q25?

OR expects sales volume in the Mobility business to decline due to the low season and anticipate a slight stock loss due to lower oil prices. However, GP/L is expected to remain within the range of THB 0.70 - 1.20 per liter. As for the Lifestyle business, the long holidays and hot weather in April led to strong sales growth at Cafe Amazon. As a result, the EBITDA margin is expected to remain strong.

2. What is your forecast for energy prices in 2Q25 and the rest of the year?

OR estimates the price of Dubai crude oil to range between US$ 50 - 70 per barrel, with continued high volatility. OR has managed its inventory levels prudently to minimize potential stock losses.

3. Are there any M&A deals currently under negotiation? In what sectors? When will we see clarity?

OR is currently assessing M&A opportunities in both its Mobility and Lifestyle businesses. Progress in the Lifestyle segment is expected to become clearer in 3Q25.

4. Is there a chance for the company's margin to improve, given that the Oil Fund balance is close to turning positive?

From the perspective of the Oil Fund, the primary impact on OR is likely to be on cash flow, due to the timing of reimbursements from the fund. However, this is not expected to significantly affect margins. The margin for the Mobility business is projected to remain stable within the range of THB 0.70 - 1.20 per liter.

5. What is the projected market share for the Mobility business by year-end? Will there be ongoing promotions?

Market share is expected to increase by approximately 1–2%. OR will continue to run promotions—especially in the past month, a gasoline price discount campaign led to increased sales volume and a rise in blueplus+ membership of approximately 300,000 members.

6. Regarding PTT’s plan to seek strategic partners for its subsidiaries, could you provide an update on OR’s progress in this regard?

OR is currently studying and analyzing potential partners to assess their long-term impact on the company. Further information will be provided once greater clarity is achieved.

7. Considering competitors attracting fuel customers through their membership card systems, what is OR's response strategy?

OR is enhancing its loyalty program through promotional campaigns aimed at attracting new customers while retaining existing ones.

8. How does the company evaluate the opening of new Cafe Amazon branches, and what is the 5-year growth outlook?

Over the past few years, the number of Cafe Amazon branches has grown significantly. Opening new branches requires careful consideration of various factors, including location, sales volume of both beverages and baked goods, and premium products. The use of AI to analyze data and assess the suitability of potential locations is integral, ensuring that new openings do not negatively impact existing stores.

9. Will the company engage in new joint ventures to open Cafe Amazon branches in additional countries?

OR continues to assess the feasibility of investing in neighboring countries, focusing on countries where OR already operates and sees growth potential. OR collaborates with local partners due to cultural differences and rely on their expertise to tailor products to local preferences.

10. What is the company’s investment budget for this year, and what are the key areas of focus?

OR has set a 2025 investment budget of THB 18 billion, allocated as follows:

- 40% for Mobility – expanding PTT stations and EV chargers

- 39% for Lifestyle – expanding and renovating Cafe Amazon branches, Including M&A

- 15% for Global – expanding PTT stations and Café Amazon branches internationally, with a focus on Cambodia

- 6% for Innovation – developing platforms to support Mobility and Lifestyle businesses.

11. How many new PTT stations and EV chargers does the company plan to expand this year?

OR aims to expand 100 PTT stations and install 250 EV chargers (600 DC chargers) in Thailand.

1. What is the revenue growth target for 2025, and why? Also, how many new PTT stations will be opened?

OR aims for oil sales volume growth of 3-5% from the previous year and plans to expand by opening 100 new PTT stations.

2. How much is capital expenditures (CAPEX) for this year and what will it be used for?

OR planned capital expenditure (CAPEX) around THB 19 billion, divided as follows:

- Mobility 40% – For the expansion of service stations and EV chargers.

- Lifestyle 39% – For the expansion and renovation of Café Amazon, including M&A.

- Global 15% – For the expansion of service stations and Café Amazon, focusing on Cambodia.

- Innovation 6% – For the development of platforms to support the Mobility and Lifestyle businesses.

3. What is the business outlook for 1Q/25?

For the Mobility business, sales volume is expected to slightly decrease from 4Q/24 due to seasonal factors. Meanwhile, the Lifestyle business is projected to achieve an EBITDA margin of 26-30%, leading by Café Amazon brand.

4. What is the plan to increase oil market share in 2025?

In 2024, OR had a 39.2% of oil market share, which dropped from the previous year. So, OR targets to boost oil market share by 2-3% in this year. To achieve this target, OR plans to launch campaigns and promotions, which are more accessible to customers and meet their needs. These are expected to positively impact to the retail oil market.

5. What is the investment deal for 2025?

For the Lifestyle business OR is in the process of finding a suitable deal to replace Texas Chicken in 2Q/25. Regarding the Mobility sector, negotiations are ongoing, with expectations to finalize the deal by the end of 2025 or 1Q/26.

1. Following the company's clarification regarding the DSI news, we want to know the next steps OR will take to protect your reputation. Will you file a complaint or pursue legal action?

We have already issued a clarification through SET. Currently, we are gathering information. If anyone is found to have intentionally spread news that damages OR's reputation, we will take appropriate legal action.

2. What is the outlook for 4Q24 performance? Is it expected to grow compared to the same period last year, and why?

The performance outlook is expected to show growth in both revenue and profit, as it is the high season for the business.

3. Will the revenue target for 2025 grow compared to 2024, and why?

Fluctuations generally influence the company's revenue in oil prices. However, we aim to maintain target margins through the Performance Uplift initiative, which focuses on 4 key areas:

- Cost Control: Enhancing cost efficiency, such as the coffee sourcing project, ensures optimal pricing and high-quality coffee beans.

- Portfolio Management: Periodic investment reviews to ensure long-term business sustainability.

- Price Risk Management: Strengthening oil price management through derivatives to mitigate company risks.

- Dashboard Implementation: Leveraging digital transformation to enable real-time monitoring and decision-making.

4. What are the targets for opening PTT Stations, Cafe Amazon, and EV stations?

PTT Station: We aim to open 100 stations but expect to achieve 90. Cafe Amazon: The goal is to open 300 branches, which is expected to be on track as planned.

EV Stations: The target is 550 locations, with an anticipated achievement of 460 locations this year.

5. What is the investment plan for 2025, and what are the funding sources?

The investment plan is currently being presented to the board of directors. It is expected to be disclosed by December 2024.

6. What is the progress on plans to discontinue unprofitable businesses?

Currently, the matter is still under consideration. In the short term, no actions are expected to be taken.

7. What is the progress on finding partners to strengthen OR in line with PTT's policy?

We are currently finding partners to take over Texas Chicken's operations. Clear developments are expected by 2025.

1. How is marketing margin in 3Q24?

Typically OR’s margin is around 0.70 - 1.20 baht/liter. It is expected that the marketing margin for 3Q/24 will be similar to 2Q/24 at 0.90 baht/liter.

2. What is the plan to regain market share?

We launched strongly promotions and marketing plan to recover sales volume.

3. How is the new Oil fuel fund policy expected to impact OR?

The impact of the new policy cannot be determined and will need to wait for clarification from the government. The retail oil market is highly competitive so the government may need to use the oil fund to help.

4. How does the appreciation of the Thai baht affect OR?

The appreciation of the Thai baht typically results in a decrease in exchange rate profits for OR whose business primarily involves net foreign currency receipts. However, it also leads to a reduction in the cost of purchasing oil at the refinery, which lowers the price formula.

5. Could you provide the outlook for each business in 2H24?

Mobility – It is expected that sales volume will decline seasonally during the rainy season in 3Q24 and will increase again in 4Q24. However, the overall sales volume for the year is likely to be weaker compared to the previous year. Meanwhile, the gross profit margin for the entire year of 2024 is expected to remain at 0.90-1.00 baht/liter. Lifestyle – It is expected that the EBITDA margin will remain stable at 27.0-28.0%, but sales volume will decrease due to the low season in 3Q24. However, for the entire year, sales volume is likely to be higher than last year thanks to Cafe Amazon's cup sold achieving new highs in nearly every quarter this year. Global – Growth is expected primarily driven by increased sales and improved margins in Cambodia and the Philippines.

6. What are the expansion plans for 2024?

OR aims to expand with 100 new PTT Station branches, 300 new Cafe Amazon branches, a total of 20 PTT Station branches abroad, and an additional 550 EV Station locations.

1. How much is the CAPEX for the year 2024, and how is it planned to be used?

The CAPEX is approximately 23,100 million baht, which is divided into Mobility 8,800 million baht, Lifestyle 10,100 million baht, Global 2,100 million baht, and Innovation & New Business 2,100 million baht.

2. What are the performance trends for 2Q/24 compared to the previous quarter and the same quarter last year?

The performance trends for 2Q/24 show continued growth, in line with oil prices and Thailand's GDP. GP/ Liter remains in the range of 0.70 - 1.20 baht. The Lifestyle business is expected to maintain an EBITDA Margin at 27.0%, and the number of cups sold by Cafe Amazon continues to grow steadily.

3. Target revenue of 2024?

More than 90% of OR's revenue comes from the Mobility business. Therefore, the revenue growth target is expected to align with oil prices and the volume of oil sales, which grows in accordance with Thailand's GDP.

4. What is the oil price outlook in 2024?

The oil price trend for 2024 is expected to be volatile within a narrow range, with prices anticipated to be between $80-85 per barrel.

5. What is an expansion plan in 2024?

PTT Station aims to expand by 100 stations in 2024. Meanwhile, Cafe Amazon plans to open a net total of 300 new branches. The expansion of international branches will be slower, as the economic conditions in each foreign country, resulting in only a slight increase in new international branches.

6. What are the expansion targets for the health and beauty business?

Initially, the health and beauty business will undergo a market testing phase. The first branch is set to open in 3Q/24. There will be an additional 2-3 branches opened within 2024 and a total of 10 branches by 2025.

7. Is there a possibility of seeing additional M&A activity this year? If so, what type of business would it involve?

We have an annual budget allocated for M&A activities. However, we are currently in the negotiation phase, which prevents us from disclosing further details. We will inform you once there is clarity on this matter.

8. How was the overall economic outlook and purchasing power in 2Q/24? And what were the directions for 2Q/24?

The overall Thai economy has experienced sluggish growth, as indicated by the figures released by the National Economic and Social Development Council for 1Q/24, which stood at 1.5%. This slowdown is attributed to the downturn in the tourism sector and private sector spending. Additionally, the inflation rate in Thailand remains relatively low. Therefore, it is believed that there is not much impact on the purchasing power of Thai people. It is anticipated that in 2H/24, when government spending increases, the Thai economy will experience improvement in growth.

9. How has the growth of Cafe Amazon been in 2024?

The expansion of Cafe Amazon continues with a focus on suitable and competitive locations. However, OR is currently not solely focused on branch expansion but also on increasing the ticket size by introducing additional products in the stores. These products include bakery items, home use products, merchandise, and products from the Ohkajhu brand, aimed at maintaining EBITDA margin levels.

10. What are the plans for investing in the Virtual Bank business?

OR is open to investment opportunities, focusing on businesses that have the potential to generate appropriate profits and align with OR's business strategies and directions. However, regarding the Virtual Bank business, it may need to wait until after BOT considers issuing licenses to applicants before proceeding.

11. CVS in Cambodia operates under which brand?

Currently, CVS in Cambodia are conducted under the Jiffy brand.

1. How much is the CAPEX for the year 2024, and how is it planned to be used?

The CAPEX is approximately 23,100 million baht, which is divided into Mobility 8,800 million baht, Lifestyle 10,100 million baht, Global 2,100 million baht, and Innovation & New Business 2,100 million baht.

2. What is the expectation of the performance trend in 2024 compared to 2023?

Considering the forecast of the macroeconomic factors, it is expected that in 2024, there will still be opportunities for growth in all business segments. This includes the growth opportunities in the aviation fuel sector due to the growth in the tourism sector, which also affects public consumer spending, leading to growth in the lifestyle business. The profit margin per liter of fuel sales is still expected to be around 1 baht +/-.

3. How much is the current financial cost?

The current financial cost is approximately 3.3%, which is expected to increase slightly but is considered to have no impact on OR.

4. OR reports that it is a Net USD Receiver, and how do changes in the exchange rate affect OR's income?

The impact depends on the direction of the exchange rate. If the Thai Baht strengthens, there will typically be an FX loss. Conversely, if the Baht weakens, there will be an FX gain. However, since the proportion of income in USD is not significant compared to the majority in Baht, the overall impact may not be substantial.

5. What investments OR will be making this year, and when are they expected to occur?

OR plans to invest in the Health and Beauty and F&B businesses, which are expected to be seen this year. If there are further details, I will inform you again.

6. Is there any growth trend in oil sales in 2024 compared to 2023? Are there any supporting factors?

It is expected to grow in line with GDP growth, estimated at 3%, supported by the recovery of the tourism sector. Aviation fuel sales volumes are anticipated to return to near pre-COVID-19 levels.

7. How are the market direction and oil sales volume in 1Q24?

It may be too early to estimate sales figures, but the initial profit margin per liter is expected to remain in the reasonable range of 0.7-1.2 baht per liter.

8. What is the impact of switching to Euro V on the market?

Normally, OR's gross profit margin per liter changes according to market conditions and remains within a narrow range. Switching the oil specification to Euro V is not significantly different from Euro IV, as OR still uses a cost-plus business model.

9. Does the underfilled tank trend's impact on oil sales 1Q24 and how the company addressed this issue?

In 1Q24, the impact is expected to be minimal. OR has a requirement for all service stations to conduct monthly tests of fuel dispensers, once a month, and to send the test results to OR and the Department of Weights and Measures. The results of the dispenser tests are checked to comply with the Ministry of Commerce's regulations.

10. How is the progress of expanding EV Station PluZ in the format without gas stations? When will the expansion plan become clear, and what is the target number of branches to be expanded?

To meet the needs of electric vehicle (EV) users, OR has planned to establish EV Station PluZ Hub, a charging station equipped with DC fast chargers, with a minimum of eight DC connectors/location. The installation targets approximately eight locations in provinces such as Kamphaeng Phet, Saraburi, Nakhon Ratchasima, Prachuap Khiri Khan, and main routes. The first EV Station PluZ Hub is expected to be seen in 3Q24.

11. What is Fit Auto's approximate market share, gross profit margin, and net profit margin?

There is no policy to disclose brand-specific information.

12. What percentage did Otteri's branch expansion grow in 2023 and 2024? Are there any plans to expand further?

Currently, Otteri has 1,104 branches, growing by 263 branches from 2023 (+31%). They plan to expand by approximately 340 branches in 2024 (40 branches within the OR Platform, 300 branches outside the OR Platform), totaling around 1,600 branches.

13. How does OR select tenants?

Considering the suitability of the location for the branch.

14. What is OR's strategy for selecting convenience store brands, whether Jiffy or Seven-Eleven and what is the number of branches for each brand?

The selection is based on the suitability of each area and according to the agreement with CPALL. As of the end of 2023, there were 2,317 convenience stores in Thailand and 90 stores overseas.

15. How is the LPG warehouse investment progressing in Cambodia?

I will let you know when there are any updates.

16. What is the reason for the decrease in oil sales in the Philippines and Laos, and does this decline affect the entire industry or only the company itself?

The decrease in sales volume QoQ in the Philippines is mainly due to a reduction in aviation fuel sales to some airlines and increased market competition leading to a decrease in diesel sales to industrial customers. On the other hand, in Laos, the QoQ sales volume increased due to an increase in diesel sales to industrial customers.

1. The economy expanded relatively low in the third quarter. How does this impact on company performance? How is the growth this year progressing, and whether it is in line with the target? What factors contribute to the growth of each business segment?

Although the Thai economy has adjusted downward in the third quarter, the main causes are the weakened export sector and government spending. However, domestic consumption continues to grow. Nonetheless, the Mobility business has experienced a decline in sales volume due to seasonal factors, but the gross margin remained at a stable level. The Lifestyle business continues to grow steadily . Therefore, the growth of OR's business in this year is expected to proceed as planned. The Mobility business remains a key segment with a strong profit margin which is still in an appropriate frame. It is anticipated that the aviation fuel will grow in the fourth quarter. As for the Lifestyle business, it is expected to maintain an EBITDA Margin of at least 25%.

2. How did the company assess its performance in the coming year amidst the relatively low expansion of the global economy and what are the perspectives on business growth?

Even though the global economy and Thai economy in 2024 may not grow as expected but the nature of OR's business as a retail business suggests that there will still be continuous growth next year, especially in the Lifestyle business segment. The focus will remain on expanding branches and emphasizing cost management, including securing the supply of coffee beans. OR has collaborated with farmers to cultivate coffee beans, resulting in increased income for farmers and reduced costs for the company. Additionally, new businesses that have invested with partners are gradually recovering. As for the Mobility business, it continues to be the core business, providing consistent and continuous positive income, serving as OR's cash cow. Next year, OR aims to increase profitability in products with high profit margins, such as premium petroleum products, asphalt, and aviation fuel.

3. How does the company view the trend of oil prices next year, and how will it impact the costs and sales volume?

It is expected that the average oil price will be around $80 per barrel. However, due to OR's business model involving the purchase and resale of petroleum products, the business model is likely to be cost-plus. Therefore, it is anticipated that OR's profits will remain at a satisfactory level. Additionally, OR has growing international business operations, with expectations for improved performance in nearby countries like Cambodia.

4. What is the performance trend for the period 4Q/23, and how many new outlets of PTT Station, Cafe Amazon, and EV Station PluZ?

In terms of sales volume, it is expected to see improvement in 4Q23, especially compared to 3Q23. This is due to the high season and festive holidays, leading to increased travel and spending. However, the overall business performance in 4Q23 may slightly soften compared to the relatively high base of 3Q23. Typically, the operational expenses tend to be higher in the fourth quarter than in the other quarters. Nevertheless, the overall performance for the year 2023 is anticipated to be better than the previous year. By the end of 2023, for the number of PTT Stations, it is expected that a total of 90 stations will be added. Additionally, the number of Café Amazon stores is expected to increase for another 340 branches, and around new 500 locations of EV Station PluZ will be set up.

5. Why the total revenue for the year 2023 tends to be lower than the previous year?

The majority of the company's revenue comes from the Mobility business, which is significantly influenced by factors related to oil prices. The average oil prices this year are lower than the previous year, leading to a reduction in total revenue.

1. How is the outlook performance for the second half of this year? Will it be better and from what factor?

We expect that the economy and tourism recovery will be a positive factor for OR in the second half of the year.

2. Currently, what is the proportion of the revenue from Mobility and Lifestyle? How much do you expect for the growth this year?

More than 90% of revenue comes from Mobility, but in terms of EBITDA, Lifestyle accounts for 25%.

3. Are there any M&A Deals under negotiation and what kind of business are they? How many deals are expected to be achieved? How much are they worth?

There are many deals in OR’s pipeline both small and large size. We continuously focus on F&B, Health & Wellness, and Beauty businesses. We consider and look for appropriate businesses. Also, we will for clarity before being able to disclose.

4. What’s the benefits from XplORe application?

OR has strong physical platforms both PTT Station and Café Amazon.

xplORe is an online platform that aim to facilitate customers’ spending, collecting, and redeeming points from OR’s brands and partners. xplORe will be linked from Offline to Online. In addition, various applications that OR already has, such as Café Amazon Blue Card and Blue Connect, are also combined into one single source of xplORe, which can match all lifestyles and convenient daily life.

5. How much the loss from investing in Flash?

OR recognizes the fair value of Flash according to the accounting standards, mark-to-market method, which shows in the other comprehensive income under the equity. After OR invested, Flash raised more funds in the next series, which OR did not invest more.

6. What is the expansion plan for PTT Station, EV Station PluZ, and Café Amazon? How many outlets we can expect by the end of this year?

Expansion plans for 2023 as follows:

- 100 New PTT Stations

- Currently, EV Station PluZ covers 77 provinces nationwide. Expecting that there will be 800 locations in total by the end of 2023

- 400 New Café Amazon Outlets. We may not mainly focus on branch expansion. Instead, we will focus on maintaining margin levels and increasing the ticket size in order to boost up the EBITDA of the Lifestyle business.

7. Is there any plan to push forward your subsidiaries to be listed in the stock market?

As for the companies that OR invests in, there are 1-2 companies that have potential and plan to be listed in the stock market. Pluk Phak Praw Rak Mae (Ohkajhu) is one of them and is in the process of preparing for an IPO plan. Also, there are other potential companies that we consider for clarify and performance.

8. Could you share the progress of the aircraft refueling business in Cambodia?

At present, the airport is under construction in Phnom Penh, Cambodia. It is expected to open for service in March 2025.

1. What are the support and challenge factors on performance 2H23? And What are 2H23 outlooks for each business segment?

We estimate our 2023 performance will be better than the previous year. However, we still closely monitor the volatility of the global oil market, which directly impacts our performance. Additionally, we keep an eye on recessions in US and EU and Russia-Ukraine situation. There are many vital positive factors, such as reopening the country, resulting in consumption resumed and more domestic and international traveling leading to higher oil volume growth, particularly in aviation fuel. We estimate overall 2H23 performance will grow continuously for all business segments.

2. The wage rate is likely to increase. Will OR be affected by this factor, and what are the strategies to deal with this issue?

Since we do not employ based on minimum wage rate and our business model is comprised of 20% COCO (Company owned Company Operated), meaning that we are responsible for the expenses only for service stations and the stores in the COCO model, we estimate the impact of rising wages may not be severe and will be in a manageable level.

3. What is the average marketing margin in 2Q23 compared to 1Q23?

Normally, the marketing margin will be at the level of 0.70 – 1.20 baht per liter. We aim to maintain the marketing margin at 1.00 baht per liter in 2Q23 as global oil prices decline resulting in less pressure on our oil prices.

4. Will oil sales volume continue to grow in the next quarter? Are there any supportive factors?

Typically, oil sales volume grows in line with the GDP. NESDC forecasted Thailand’s GDP growth at 2.7%-3.7% this year. We expect the total sales volume for this year grow better than GDP, mainly from aviation fuel due to increasing domestic and international traveling. Sales volume in 2Q23 will be close to those in 1Q23.

5. What is the trend of stock gain/loss in 2Q23?

In a situation where the oil prices do not fluctuate, it will be easier for us to manage stock gain/loss like in 1Q23, in which our stock gain/loss was not at a high level. We expect to keep the same stock gain/loss level in 2Q23. Although, we need to hold stock according to the legal reserve, which means that having stock gain/loss is a normal practice in this business.

6. What is the PTT Station expansion plan for the rest of this year?

This year, we plan to expand PTT stations to about 100 more locations, which we already achieved 7 locations in the first quarter. However, we do not only focus on the number of service stations but will pay attention to generating more profits in each station for optimize benefit.

7. How is the progress of the investment in Flash Express and Lineman?

There is no additional investment in Flash Express, resulting in a decrease shareholder portion. We will monitor the performance closely. For Lineman, our objective of this investment is financial return. Hopefully, we may receive the return from IPO in the future.

8. There are rumors that OR will acquire PTG. Is it true?

This is outside our plan. Our current market share of oil sales volume is appropriate, so there is no need for any acquisition.

1. In the previous year, OR had used high working capital. How does OR plan to manage this issue in 2023?

- OR’s receivables were high in 2022 mainly from the oil fund receivable, this situation impacted on our liquidity, thus we were closely monitor to avoid liquidity risk and procured line of credit from commercial banks for serving additional liquidity.

- Tris rating declared OR Credit rating at AA+ and with a credit rating outlook of "stable" on Feb 14th,2023. This will benefit OR to have capability to seek alternative fund raising with effective cost of fund in the future.

2. How will OR manage high amount of account receivable and oil fund receivable?

- At the end of 2021, the amount of oil fund receivable was at THB7,993 million. It continuously increased until it reached the highest point, around THB38,000 million, in September 2022. However, during November 2022 to February 2023, we received repayment from the oil fund almost THB16,000 million, resulting in a decrease in our receivable. As of February 2023, the outstanding of oil fund receivable has decreased to around THB21,000 million.

- We expect that oil fund will gradually repay us throughout the year 2023 and the outstanding of oil fund receivable will return to normal level within 2024.

3. Will OR need high working capital for inventory in 2023?

Apart of working capital will be utilized for inventory which are vary in line with global oil price trend. Inventory at end of 2022 went up from uptrend global oil price. However, we expect oil price 2023 may lower than previous year leading to less working capital.

4. Currently, Does OR need additional interest bearing debt?

Currently, no additional debt required.

5. What is OR’s CAPEX for 2023?

Our Capex for 2023 is approximately THB31.2 Bn.

6. Oil retailers in Thailand try to balance the proportion of account receivables and account payables to increase their liquidity. What is OR’s view for this issue in 2023?

OR has managed our account receivable and account payables properly and effectively to make sure that we have an appropriate level of liquidity.

7. OR performance has come into slowdown from the view of shareholder and investor. What is your perspective regarding this point?

Generally, there are various views on market expectation. However, our management believed that our 4Q22 performance might be the bottom. We believed that we will able to achieve our goal in 2023 as planned.

8. What is the trend of 1Q23 oil sales volume? How the 1Q23 performance will be? What is the growth of 2023 and from which the key factor?

Normally oil volume sold go along with GDP growth (NESDC ‘s outlook on Thailand GDP growth in 2023 is projected to be in the range 2.7-3.7%). Our oil volume growth in this year may rise above the GDP growth mainly from aviation fuel as tourism sector recovers from an increased travel and the country reopening. We believe our 1Q23 performance will be improved from the increasing of sales volume. Also, marketing margin is expected to be back to the normal level at 0.70-1.20 Baht/liter.

9. According to the declining of global oil price due to the global banks’ crisis, are there any impacts on OR’s stock gain/loss or does OR need to record any provision?

- OR manages our inventory based on demand and supply . If the global oil prices are highly volatile, we can get impacted both positive and negative side. Stock gain/loss are presented under cost of goods sold item. Please keep in mind, we calculate it separately for analysis purpose. Stock gain/loss is the normal business operation of oil business that requires minimum storing of inventory as legal requirement.

- While provision of net realizable value considers as accounting treatment, we would record when it meet accounting criteria.

10. Please provide outlet expansion plan for ptt station and EV charging station in 2023.

- 204 ptt station (Thailand 122 locations/oversea 82 locations )

- 500 locations of EV station PluZ in Thailand

11. What is your prospective regarding EV adoption in Thailand? Does OR need to revise your business plan for EV?

- EV adoption in Thailand is quite clearer due to the supporting government policy that promote EV ecosystem. One of the important policy is called 30/30, setting a goal by 2030, the number of domestic EV car production will be around 30% of the total new cars. Moreover, the various incentives that the government supports for EV car buyer accelerate the EV adoption to grow aggressively as we can see the number of registered PHEV + BEV car has increased rapidly. We expect in the next 10 years, vehicles in Thailand will be both ICE and EV cars. Thus, OR need to fulfill readiness for future energy transition through seamless mobility

- With our strength in term of network across the country, we aim to become a leader in the EV charging business. Therefore, we are accelerating the installation of EV Station PluZ both inside ptt stations and other commercial areas through the cooperation with partners. We plan to expand another 500 new locations in 2023, and develop EV stations PluZ application to meet the needs of consumers in the future.

12. There were consolidation deals under oil retail industry in the recent year. Is there any impact to OR?

- We believed this will be good for consumers to get better products and services. All players must develop products and services to attract customers.

- As we are the market leader in the oil and retail markets in Thailand, we still have competitive advantages over other players in many aspects such as our network across the country. Our oil and non-oil offering that has three magnets inside ptt Station are 1. Good quality oil, both premium grade and regular 2. Café Amazon 3. C store 7-11, including clean energy like EV Station PluZ.

- However, the stronger of other players in the market makes us to keep developing our business in order to maintain our competitive advantage both network expansion strategies, focusing on locations that can grow and increasing profit per branch, accelerating non-oil retail to become stronger to meet the needs of customers and attract more customers to our ptt station, increasing profit to the overall business. Moreover, we are accelerating the expansion of EVs as part of maintaining the momentum of the ptt station brand.

13. Is there any investment focusing on green energy?

Green is one of key strategies under our SDG concept which is a big focus of OR business. Apart from EV charging station, we have plan to expand into other related green business such as solar roof top business.

14. What is your 2023 outlet expansion plan for Café Amazon and Texas Chicken?

We plan to expand 400 new Café Amazon outlets and 12 new Texas Chicken outlets in 2023.

15. Due to the decline in Café amazon cups sold in 4Q22, what is its outlook for 1Q23?

There are several factors that impact on Café Amazon cups sold e.g. seasonal effect, economic recovery. Although 4Q22 cup sold dropped a bit, we believed that our Café Amazon business will continue to grow in the long term.

16. Has OR plan to operate retail business outside ptt station?

Currently, OR has operated business outside ptt station especially food & beverage stores such as stand-alone Café Amazon outlets in the proportion of 44.6% of the total outlets. We have long term plan to gradually turn our lifestyle business to community space.

17. What kind of business that is attractive to OR? Is there any much more deal in your pipeline?

We allocated some parts of 2023 CAPEX plan for M&A and joint venture. Our intention is still focusing on business related to health and wellness as well as tourisms. Many deals are under negotiation stage. Official release would be made when the deal has been done.

18. How was the performance of Ohkaju for 2022?

Ohkaju performance in 2022 has gradually improved after COVID-19 endemic. Its performance will grow continuously following positive factors such as softer inflation and economic recovery.

1. What is the approach to hedge inventory in the next quarter? (since last year there was a large amount of cash used in working capital)

OR has the inventory days of 10-14 days, including legal reserves. OR manages inventory to suit the amount of sales. For risk management, OR has a hedging policy of no more than 50%, which will depend on the market condition at that time as well. In Q3, OR had higher stocks than usual due to 2 factors: 1. Rising oil prices; 2. In Q4, there are refineries that have planned shut downs, resulting in reserving higher stock in 3Q/22 than usual in order to support the sales volume in 4Q/22.

2. Are there any big M&A deals that will significantly affect performance? The proceed from IPO is quite high; how is this proceed managed?

There are various sizes of investment negotiations in the pipeline, and each deal will be completed depending on a variety of factors, such as the complexity of the deal, parties to contracts, conditions, etc. Therefore, by the end of 2022, it is expected that there will be no more deals done than what has already been announced through SET.

As for the proceeds received from the IPO, the proceeds have been gradually used according to the objectives notified to the SEC, which were disclosed in the prospectus upon the sale of securities.

3. In the 3rd quarter, there was a large increase in administrative expenses due to what reason?

Consisting of one-time and recurring expenses, because during the COVID-19 pandemic, OR did not bring out big marketing campaigns, so in 3Q/22, OR started doing promotions leading to expenses for both the Mobility and Lifestyle businesses. The one-time expenses include, OR’s event called “Inclusive Growth Days”, which showcased OR’s new vision, in which prospective SMEs that would like to work with OR were invited, and this event was opened to the public as well. This was to create awareness for OR's businesses. Another event was the Motor GP event.

4. How is the trend of the results of the 4th quarter compared to the 3rd quarter and the same period last year? And how much revenue is expected for the year 2022?

Considering the macroeconomic indicators such as Thailand's GDP, the growth of the tourism sector, etc., including the country's full reopening since October 2022 and the fact that the fourth quarter is the peak period for traveling. It is expected that the sales volume of both Mobility and Lifestyle businesses, including overseas operations will be better than the third quarter, including positive impact from price adjustments for every menu at Cafe Amazon by 5 baht/cup, which will help the Lifestyle business maintain EBITDA margin level after encountering higher costs from inflation in the previous quarter.

5. How is the revenue target in 2023? How much is the investment budget in 2023 and what will it be used for?

Normally, OR's revenue will grow according to the economic growth in Thailand and changing oil price level in the world market. By 2023, PTT Group expects oil price to be 89 USD/BBL.

In 2023, the investment budget is set at THB 31,196.70 million to be mainly used for expanding the networks for Mobility, Lifestyle and Global businesses, including related ventures.

6. Opening a laundromat in a service station: What are the advantages of investing? And invested by whom?

The 40% joint venture investment with Knex in the automatic washing and drying business under the brand Otteri meets the lifestyle needs of the new generation who do not spend time doing housework by themselves. Opening an Otteri outlet in a PTT Station will help increase the number of service users in service stations. According to statistics, on average, service users in service stations spend about 30 minutes per visit, where they will spend the time shopping at other retail outlets in the service station.

7. What caused sales volume decrease in Laos?

In 3Q/22, Laos saw a decrease in sales volume for all products from the impact of oil shortages due to import restrictions as a result of shortage of foreign currency.

8. Do you have plans to have hotels in PTT Stations?

Since OR has little expertise in the hotel business, therefore, it will take some time to study and analyze the feasibility and will require OR to consider the appropriate time to invest.

1. What is the outlook for earnings in the second half of 2022?

OR expects the overall operating results to continue to grow, when considering various factors such as GDP growth, the policy of opening the whole country and neighboring countries in the region, the relaxation of measure encouraging foreign tourists' entry, etc., all of which encourages the volume of oil sales in both Mobility and Global businesses to continue to increase. The cost increase in main raw materials such as coffee beans was mostly realized in the second quarter, so in the second half of the year, although there may still be an impact, the effect should be minimal. The gradual recovery of the economy will help to increase economic activities, which will have a positive effect on the Lifestyle business revenue, both in the F&B and Other Non-Oil businesses. It can be seen from the second quarter that the number of cups sold at Cafe Amazon hit a new high and is expected to continue to grow at a high level.

As for the global business, it will continue to grow as well. Especially in the Philippines and Cambodia according to the factors mentioned above, except Lao PDR, that may be impacted by problems in their domestic economy.

2. How many other M&A deals are there and what type of business are they? How many deals will be concluded by 2022?

There are deals that are still under the process of negotiation. If these deals are successful, a few more deals will be revealed later this year. The businesses that OR is interested in, in addition to F&B, includes businesses that provide opportunities that respond to changing consumer behavior, including creating opportunities in growing together both domestically and abroad.

3. What is the trend of crude oil prices in the second half of the year?

It is expected that oil prices in the world market will continue to be quite volatile, but the overall average price should be lower than in the first half of the year, due to concerns about the potential economic slowdown and from the inflation situation in many countries.

4. How is the expansion of PTT Station and Cafe Amazon in 2H/22?

OR adjusted our network expansion plans in 2022 as follows:

- PTT Station 117 stations, originally 129 stations

- Cafe Amazon 415 outlets, originally 389 outlets

5. How is the marketing margin of Q3 compared to Q2?

Market margins in the third quarter of 2022 are expected to weaken compared to the previous quarter, where the marketing margin is higher than normal. The marketing margin in the 3Q/22 is expected to remain at plus/minus 1 baht.

6. If oil prices continue, how will this higher cost effect marketing margins? And will the cap on diesel at service stations affect marketing margins negatively?

Rising oil prices have pressured oil retailers to adjust retail prices at service stations to be in line with rising energy prices in the market, resulting in low marketing margins. In addition, consumers tend to reduce travel during this period, however. Managing each oil retailer’s existing stocks during an uptrend in oil prices could create a positive effect on overall market margins. The oil market in Thailand is a free market, so oil retailers that freeze their diesel price during an uptrend in oil prices might miss their target marketing margins. However, this may lead to higher sales volume compared to other players who raise prices.

1. Taste of drinks at Cafe Amazon seems to vary from branch to branch. Does OR conduct tests or has an audit system in place? Also, competitors started employing automation to achieve consistency of taste, thus a concern that the popularity of OR's coffee will start to decline.

OR appreciates all comments and suggestions from investors.

OR places great importance to product quality. In the quality control process OR requires the franchisees of Cafe Amazon to undergo training and pass a store manager training course before operating the store. In addition, OR will send a team to set up and provide on-the-job training before the store opens to build confidence in the quality of the product.

OR will have an Audit team to check the store’s standards on a monthly basis and also have a Mystery Audit team to check in case the store received low scores from the assessment, complaints or get poor service scores, including Mystery Shopper who is outsourced to assess the stores from a perspective of the customer a few times per year.

Currently, OR is exploring the use of robots to help make coffee to also try to develop and continuously improve the quality of our products and services.

2. How does the cap on diesel retail price and reduction of B100 in the mix affect OR?

OR has helped reduce the burden on consumers by slowing down the price adjustments at oil retail service station. Since the end of 2021, OR’s selling price is lower than other brands for nearly the entire of 1Q/22. As a result, OR has increased diesel sales volume.

3. How much growth in performance will we see in 2Q/22 compared to 1Q/22 and 2Q21? What are the supporting factors? What’s the outlook for the rest do 2022?

From the numbers in April, volume for gasoline and diesel continues to grow, and another contributing factor to volume growth is Jet fuel as the country reopens for tourist, hence benefitting from more flights (compared to last year’s figure where we lost almost 70% of Jet fuel’s volume)

4. Competitor's new service stations appear to dedicate more areas to support trucks. According to OR, what are the advantages & disadvantages?

Currently, OR has 10 service stations in the form of PTT station Truck Park. The highlight of this type of service station is the wide area because it has to accommodate quick diesel refueling service for large vehicles. This main advantage helps increase diesel sales volume, contributing to an increase of the overall sales volume. Nonetheless, the Truck Park must also be designed to have special facilities compared to the standard service station. This includes having less non-oil offerings, where margin is often high, compared to the usual service station, due to the fact that the consumer behavior for this type of service station focuses on buying fuel only.

5. How is the budget allocated for the rest of 2022? For what purposes, and short-term investments seen in 1Q/22 was from which item in the investment assets?

For the THB 54,000 million from the IPO, OR has a 5-year investment plan that has been detailed in the filling document, which will be gradually invest according to the plan stated in the filing.

As for the money that has not been invested according to the plan, we’ve use that to invest in short-term investments, such as various funds, and recorded as short-term investments of not more than 1 year or not more than 3 years

For investments in new businesses, that will be from money that OR receives from operations.

6. Tesla, the US automaker began to expand in Thailand. Will it affect the use of oil, oil and OR's business?

In situations where energy prices are high, the electric vehicle (EV) is a car that uses clean energy, is an alternative for consumers. It is projected that Thailand in the next 5-10 years, the number of EVs will increase exponentially, and OR has already planned to support in this regard with plans to expand EV charging stations to cover all potential areas, both inside and outside of PTT stations. The expansion plan in 2022 will include 350 additional EV Stations PluZ to meet consumer demand.

FIT Auto, OR's current ICE vehicle maintenance facility, is planning to expand into EV repair services, which is currently in collaboration with EV carmakers in the study phase.

Therefore, the arrival of Tesla in Thailand is a business opportunity that OR may potentially have business cooperation within the future.

7. What is the outlook on oil prices for the rest of 2022?

According to the forecast from the PTT Group, the price of crude oil is likely to be around 100 USD/Barrel.

8. Currently, there is an acquisition deal or investments in the pipeline? And in what businesses?

There are still quite a lot of deals, but everything is still confidential. Most deal are in the Lifestyle business because we want to meet the needs of consumers that are changing in the future. There will be both F&B and others as well. In the past, the process was slowed down due to the COVID-19 situation, which made contacting and coordinating quite difficult. This year the process is expected to be faster.

9. How is marketing margin for this year compared to last year’s?

Usually, the marketing margin will trend in a narrow range. The government’s recent policy to reduce the burden on the public and business sectors using the oil fund mechanism and reduction of excise taxes during high energy prices helps reduces the burden on operators such as OR as well, meanwhile, OR also has to closely manage the cost of purchasing from the refinery. Therefore, OR is expected to be able to maintain the level of marketing margin that is close to the first quarter

10. Expansion plan for service stations, non-oil business this year? How much is the investment budget? What are your plans for overseas expansion?

Still in accordance with the original plan. In 2022, there is a plan to expand 195 PTT Stations (Thai 129, International 73) and open 518 Cafe Amazon stores (Thai 389, International 129). In the past, the network expansion may open lower than other quarters, which is normal for business, but during the 2nd-4th quarter, it will expand more. It is expected that it is still in accordance with the plan that has been laid above.

11. What is the growth target for 2022? How much is revenue expected to grow, and how much is the expected revenue growth for the next 3 years?

Average growth for OR is in line with gross domestic product (GDP) growth, which is projected to grow in line with Thailand's GDP in 2022 at around 2.5%-3.5%.

12. How much is the investment in venture capital or startups together today? and how much investment is set aside for this year?

Finnoventure Private Equity Trust I at THB 150 million

SeaX Fund II L.P. at THB 50 million

Investment through ORZON at THB 221 million

In 2022, an investment budget for innovation is set at approximately THB 3,700 million.

13. Average space rental rate in PTT Stations?

OR seeks more retail content that is not energy related. The rent is slightly different depending on the area, both in the city and outside the city. Moreover, OR wants to grow sustainably together with the SMEs, so the rent will be comparable to the market rate.

14. Which item is the increase in trade accounts receivable? Is there a chance of bad debt?

Increased other receivables from a refund from the oil fund, and the increase in trade accounts receivable increased from rising oil prices.

Bad debt is a very small proportion because OR has a clear credit process.

1. How much will the revenue target for 2022 grow from 2021 and what is the direction of the performance during Q1/22?

Most of OR's revenue (90%) comes from the Mobility business, which varies with the level of oil prices and oil sales volume. From the preliminary assessment, it is expected that the average oil price level in 2022 will be higher than that of 2021, and in terms of sales volumes, it is expected to be growing in line with the country's GDP. At present, Q1/22, the picture is not clear. We'll have to wait for some more time to collect information.

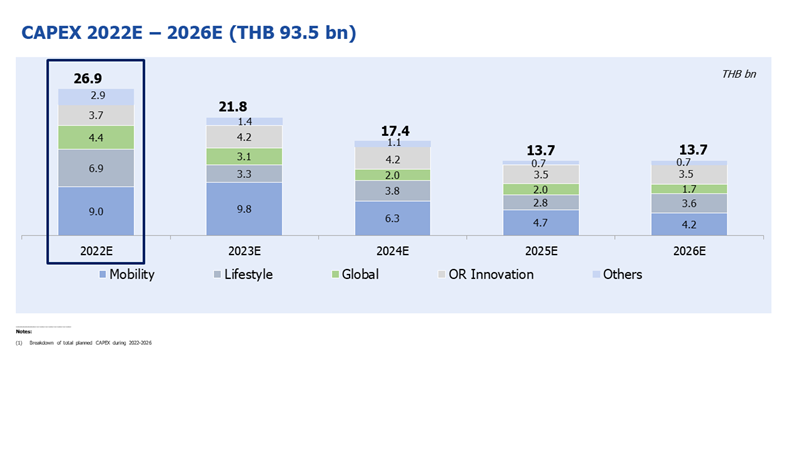

2. How much is the investment budget in 2022 and how is it used?

Investment budget for the year 2022 - 2026, approximately 93,500 million baht (only in 2022, about 26,900 million baht), with investment plans divided by business as follows

Mobility: Mainly for expanding PTT stations and focusing on investment in clean energy, including EV Charging station both inside and outside PTT stations, including investment in solar rooftop.

Lifestyle : Most for expanding Cafe Amazon and Other F&B brands, and for other investment opportunities.

Global : Mainly for expanding of PTT stations and Cafe Amazon overseas, including searching for business opportunities through partners abroad for joint investments.

OR Innovation : Investing through venture capital and ORZON Ventures to seek business opportunities to extend the existing business, including the search for new S-Curve.

Other: Investments in various infrastructures such as IT systems

3. How can rising oil prices have a positive or negative impact on OR?

OR operates in mobility business, which has a cost-plus business model and has a relatively stable gross profit in the range of 0.70 - 1.30 baht per liter. Thus, this may affect OR but not much. OR also has a risk management policy in regard to oil prices to reduce the impact as well.

4. Expansion plan for EV charging stations in 2022?

In 2022, OR plans to expand 350 additional EV charging stations, divided into 200 inside service stations and 150 outside service stations.

5. What is the impact of government control measures to OR?

OR helped alleviate the burden of the public sector from the pressure from high oil prices in the world market. As a result, there has been a delay in the price adjustment of diesel at service stations in the past, resulting in a slight weakening of OR's marketing margin.

6. Has the price of coffee beans increased or not? And how will it affect the cost of Cafe Amazon business? How much coffee bean does the company have to support the expansion of Cafe Amazon outlets?

As OR coffee beans are sourced 100% locally, they are not based on global market price, and it is done through a bidding process in which a pre-contract is signed. Therefore, the rise in coffee bean prices has increased costs to some extent, but at present, OR has been able to maintain its EBITDA margin at a reasonable level. However, the situation was closely monitored.

As for the consumption of coffee beans of Cafe Amazon is expected to be in line with the amount of domestic production, and at present, OR is looking for ways to increase the amount of coffee beans, for example, with the Royal Project Foundation by providing local farmers with knowledge and support on cultivation of quality coffee beans in order to build strong communities, including expanding the area for coffee beans cultivation and adding green space for sustainable growth.

7. In the presentation, the 2022 oil price forecast averages 78.6 USD/BBL. From the situation of the Ukraine-Russia war, has the company re-evaluated the world oil price and how it affects the business direction?

Oil prices are expected to rise. The projected oil price in 2022 is approximately 107 USD/BBL. OR's business is a cost-plus business model, so OR will not be too much affected by the oil price increase. However, the government's request for cooperation in supporting the retail fuel prices at the service stations will result in a slight weakening of the marketing margin. In addition, the rising oil prices will also affect the Lifestyle business as it affects the inflation rate and the purchasing power of consumers may decrease.

8. What is the average sales per branch for Cafe Amazon?

Average sale per day per store in 2021 was at 15,158 baht, an increase of 9.8% from 2020 at 13,803 baht.

9. How does the company plan to manage the marketing margin during the rising oil prices?

OR operates a Mobility business using the cost-plus business model. Therefore, OR's marketing margin is not much affected by an increase or decrease in oil prices. On average, OR's marketing margin will be approximately 1 baht per liter or slightly above or below this number.

1. OR’s position and direction in the EV industry

OR is aware of the rapid changes in today's world, whether it is technology and the importance of clean energy. OR, a flagship company in the PTT Group, will play a role as the Marketing Arm in the EV ecosystem for the PTT Group. OR is well prepared to support the business transition from Oil to EV, as has studied EV business trends as long with government policies. At present, OR has installed EV chargers in 31 stations at the end of 3Q/21 and will expand to 97 stations at the end of 2021 and 300 stations by 2022, respectively.OR also has an EV application to meet the needs of consumers from searching for EV Charging Stations in areas close to the customer’s location, booking service time, checking the charging status, offering various payments, etc.

In addition to EV charging at PTT stations, OR also installs EV charging posts outside service stations. In the future, our FIT Auto will also provide EV maintenance services as well.

In this regard, OR is ready to meet the needs of all types of motorists—both of those who want to use oil and those who want to use other types of energy in the future. OR will continue to maintain its leadership in the oil ecosystem and expand our business to the energy solution ecosystem to meet all the needs of motorists.

2. Does OR have plans to use cryptocurrency?

We currently are conducting feasibility study on the matter. Nonetheless, this is subject to strict compliance with the rules and regulations of the government and related agencies.

3. Growth direction of 4Q/21 compared to 3Q/21

Several positive factors that may contribute to the outlook for 4Q/21 include the reopening of international borders, improvement of the COVID-19 situation in Thailand, progress in the COVID-19 vaccination, end-of-year holidays season where people would spend and travel during the long holidays, and increasing foreign tourists, which will contribute to an increase for both oil and non-oil sales. However, there is still downward pressure from increasing global oil prices that may softens oil retail gross profit/liter.

Furthermore, Thailand and the world still face the uncertainty of the new Omicron variant, but OR has a business response plan regarding such uncertainty through our Business Continuity Management (BCM) plan.

4. Trend of oil retail gross profit/liter in 4Q/21 compared to 3Q/21 and what should be the appropriate range for the business?

Gross profit per liter in 4Q/21 is likely to weaken compared to 3Q/21

The appropriate GP/liter range for OR is around 0.80-1.30 baht per liter.

5. What is the direction of crude oil prices? Projected oil sales volume and revenue target for 2022?

For crude oil price trends in 2022, PTT Group projects the average Dubai crude oil price in 2022 to be around 65 USD/BBL

In this regard, PTT Group regularly reviews estimates to ensure they are in line with the current situation

For oil sales volume in 2022, it is expected to recover due to the government’s policy to open the country (Thailand) starting 1st November compared to Pre-COVID-19 level, except for aviation fuel, which is expected to increase by 50% next year compared to the pre-COVID-19 level.

6. Details of the investment budget and M&A plan for 2022?

OR constantly looks for investment opportunities and synergies with startups and SMEs to extend our strengths, including PTT station network across the country, as well as non-oil businesses such as Cafe Amazon and other F&B brands with strong potential across the country. We are continually making joint investments to diversify our F&B portfolio. In the future, OR will expand our business into the Health & Wellness and Tourism sectors, which can be linked to core businesses and current customers such as organic food, fitness, etc. OR wants to go beyond the oil business while growing together with partners, society, community and the environment

As for the 2022 investment plan, it is in the process of receiving the board’s approval this month (Dec’21)

7. Size and details of deal(s) that ORZON will invest in.

The details cannot be disclosed at this time. The deal must be closed completely first. ORZON has a policy to invest in startups during the early stage by focusing on new businesses under the Mobility & Lifestyle framework such as Smart Retail, Mobility, Energy, F&B, Travel, Health and Wellness and Information Technology to expand OR's business

8. International expansion plan for existing international countries and new countries?

In 2021, the international business segment has the plan to expand 43 service stations and 46 Cafe Amazon outlets. There are also 5 branches of CVS stores under the Jiffy brand.

OR currently has a presence in 10 countries. When expanding into new countries OR will leverage its strong brand, expertise and well-accepted reputation, and adjust accordance with the needs of the market in each country, including seeking suitable opportunities for acquisitions (M&A) and/or joint ventures (JVs) in foreign countries. Countries that we are interested in and are in the process of studying business opportunities, for example, Indonesia.

9. OR’s source of fund & any plan to raise fund in 2022?

OR received funding from our IPO, and we plan to use the money to expand the oil and non-oil outlets both domestically and internationally. There is also cash flow received from operations, which will be used for M&A’s and Joint Venture.

At the present, OR has no plans to raise additional funds.

1. Has OR been affected by the weakening of Thai baht?

Most of OR's business transactions occur in the country. Consequently, OR's transactions using foreign currency are rare, below 10%, and there are no foreign currency loans. Therefore, the effect of FX on OR is relatively small. Moreover, OR offers foreign exchange risk service, closing more than 90% of the risk of trading transactions.

2. How is the performance of oil sales volume in the third quarter? What would be the projection on OR's performance for the second half of the year, including how much growth is forecasted for this year's performance?

OR's performance was primarily in line with the country's growth rate. In the third quarter, economic activity was curtailed, lockdown was concentrated in some areas. Oil sales volume declined in the range of approximately 10% compared to the previous quarter.

As for the projection on OR's performance in the second half of the year, if measures are relaxed and the city is opened for tourists, then business-related activites are likely to recover. However, there are still many challenges, such as when herd immunity can be reached and how well infection is controlled.

3. Can OR provide details about the bakery plant, and help explain the benefits of this plant to OR's business?

Currently, OR sources bakery from SMEs to sell in our Cafe Amazon stores. Therefore, having our own bakery plant and products in the stores will lead to product standardization, quality control, and cost control, which create an opportunity for OR to maintain our desired margins level in the long term. OR also aims to increase our ticket size through the non-drink portion from 9% to 13% in the medium term. We believe that the bakery plant will help drive us to reach our performance goal. Nonetheless, OR continues to focus on growing together with SMEs, and the bakery will supply 30%-40% of all products in Cafe Amazon.

4. How does higher oil prices help OR? Isn't this a cost pass through business where you only make money from higher volumes?

The oil retail price is a cost-plus model. The higher oil price does not directly translate to the margins we receive. Our oil margin is in the range between THB 0.80-1.20/litre. We recommend investors include inventory gain / loss when deriving our margin because it's one of the factors we consider when we adjust the pump price.

5. For inorganic growth, which food business niche would you find interesting? (Meat substitutes like beyond meat)

OR has many deals, both F&B and non F&B businesses, which are under discussion. We are open to exploring all opportunities related to the mobility and lifestyle ecosystems.

6. Is there any chance for us to acquire small electric vehicle battery technology to speed up our EV BUSINESS?

Currently, the adoption of EVs is still low. According to the Electric Vehicle Associate of Thailand, the number of battery EVs and Hybrid EV/Plug-in Hybrid EV account for less than 2% of the total registered passenger cars in Thailand. We closely monitor the growth of EV technology and believe that we are well-prepared to meet future demand. We also look for partnerships for the EV charging technology to strengthen our mobility platform. We also developed mobile application for our EV charging station, which provides convenience for our customers in locating our EV stations while allowing us to study the behavior of EV users.

7. How has OR been following the trend for new S-Curve businesses?

OR's investment strategy includes investing in businesses relating to and/or meeting the needs of Mobility and Lifestyle to build on our current business and investing in businesses with an emphasis on technology. Investing in Flash Group that operates a logistics and parcel delivery business, is one example of a new S-curve business that helps increase traffic at our PTT stations while also creates synergy in other aspects with OR. In addition, the investment in Care for Car and Orbit Digital are investments for the development of various platform applications to expand our current business.

8. Can you describe how OR manages its PTT stations to embody the concept of one-stop-service, and how will this help increase revenue in the long term, and what will the proportion of increase look like?

We offer a mix of products & services that aims at meeting the needs of consumers. Ensuring they can enjoy the non-oil services available at our stations while refueling and charging their vehicles at the same time. As for the outlook on long-term revenue increase, our current revenue for the space rental business comes in the form of GP sharing.

9. Is there enough coffee beans as OR expands hundreds of Cafe Amazon outlets each year?

OR source 100% of our coffee beans locally and believes that from the amount of coffee beans produced in the country per year compared to the coffee demand from Cafe Amazon outlets, we will be able to support our current and future Cafe Amazon outlets in the medium term, which is 3-5 years into the future.

10. Please provide an update on your use of proceeds from the IPO and OR's plan for M&A. Are there any progress and whether there will be any deal announcements this year?

OR has set up a 5-year CAPEX plan of 74,600 million THB with the following breakdown: 34.6% oil business, 28.6% non-oil business, 15% foreign business, and 15% other business (new S-Curve) 15%. OR will be focusing on the non-oil business segment, which provides high margins.

If OR can invest according to this 5-year CAPEX plan, the proportion of OR's EBITDA contribution from each business segment will change to the following: Oil business at approximately 50 - 52%, Non-oil business at about 30 - 33%, International business at about 13-15% and other business (New S-Curve) at roughly 5%.